Cheque fraud cases in UAE are on the rise. With increased reliance on cheques for both personal and business transactions, fraudsters have found various ways to exploit the system. In recent years, cheque fraud cases in the UAE have become a growing concern, affecting businesses, individuals, and financial institutions alike. To tackle this issue effectively, it is essential to understand the different types of cheque fraud, common techniques used by fraudsters, and the preventive measures that can help safeguard against these scams.

What is Cheque Fraud?

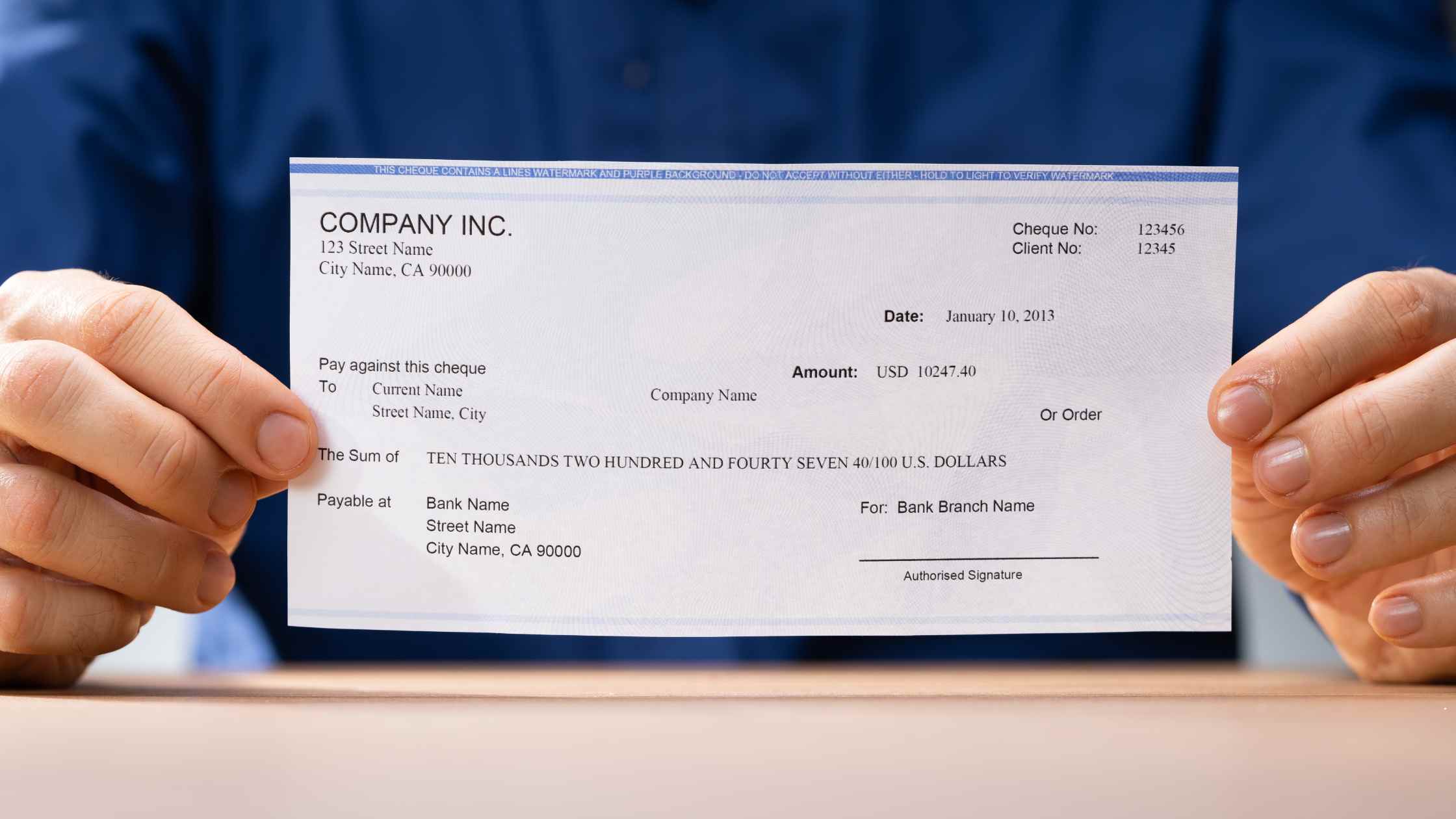

Cheque fraud can be defined as the act of depositing a fake or manipulated cheque to deceive an individual or financial institution. Fraudsters either create a counterfeit cheque or alter details on a legitimate cheque to benefit financially. The consequences of cheque fraud are severe, often leading to significant financial loss and legal consequences for the perpetrators.

The UAE government and banking sector have made concerted efforts to reduce cheque fraud cases, yet fraudsters continue to evolve their tactics. In this article, we explore the types of cheque fraud commonly seen in the UAE, examine real-world cheque fraud cases, and provide essential tips on how to avoid becoming a victim.

Common Types of Cheque Fraud

1. Fake Cheques

This is one of the most common types of cheque fraud. Fraudsters create a fake cheque that appears authentic by copying details from an original cheque or using fraudulent account information. Victims often fall for this scam because the cheque looks genuine. Once the cheque is deposited, the bank later discovers it is fake, leaving the victim responsible for the financial loss.

Real-World Case:

In a notable cheque fraud case in the UAE, a business owner received a cheque as payment for goods but later found out that the cheque was fake. The cheque had been expertly forged, and the bank bounced it after processing, leaving the business owner unable to recover the funds.

2. Cheque Manipulation

In this type of fraud, fraudsters obtain a legitimate cheque but manipulate certain details such as the amount, date, or beneficiary information. For example, a cheque written for AED 1,000 can be altered to read AED 10,000. The fraudster then deposits or cashes the manipulated cheque, leaving the original issuer unaware until their account is debited for the inflated amount.

Example:

A common cheque fraud case in the UAE involved a fraudulent individual who manipulated the amount on a business cheque. The original amount of AED 5,000 was changed to AED 50,000, resulting in significant financial loss for the business.

3. Magic Ink Technique

This method is relatively less known but highly effective. The fraudster provides a special “magic ink” pen for writing cheques. The ink appears normal at first, but after a short time, it fades or disappears. The fraudster then fills in their desired amount and beneficiary details, allowing them to manipulate the cheque to their advantage.

Example:

In one cheque fraud case in the UAE, a fraudster used magic ink to manipulate the details of a cheque that was originally written for AED 2,000. The fraudster filled in a higher amount of AED 20,000, which the bank processed, leading to significant financial damage for the cheque issuer.

4. Cheque Theft

Cheque theft is a prevalent form of fraud in which a signed cheque is stolen from its rightful owner and cashed by the fraudster. This can occur when an individual loses a signed cheque or when cheques are intercepted in the mail. Once stolen, fraudsters often change the payee information and deposit the cheque into their account.

Example:

A well-known cheque fraud case in the UAE involved the theft of a cheque from a courier service. The fraudster intercepted the cheque and altered the beneficiary details before depositing it into a fake account. The victim only became aware of the fraud when their account was debited, by which time the fraudster had already withdrawn the funds.

Legal Implications of Cheque Fraud in the UAE

In the UAE, cheque fraud is treated as a serious criminal offense, punishable under the law. According to Federal Law No. 18 of 1993 concerning commercial transactions, cheque fraud is classified as both a criminal and civil offense. Those found guilty of committing cheque fraud can face imprisonment, fines, or both, depending on the severity of the case.

The UAE government has taken proactive steps to deter cheque fraud, including implementing stringent banking regulations and introducing legal reforms. A significant reform includes decriminalizing bounced cheques in certain cases to protect individuals from harsh penalties when they unintentionally issue a cheque that cannot be honored. However, fraudulently manipulating or issuing cheques remains punishable by law.

Preventive Measures to Avoid Cheque Fraud

As cheque fraud continues to rise, businesses and individuals in the UAE must adopt effective preventive measures to safeguard against fraud. Here are some of the best practices to avoid cheque fraud:

1. Thoroughly Examine Cheques

Before accepting or issuing a cheque, carefully examine it for signs of tampering. Look for overwriting, erasures, or alterations in the amount, date, or payee fields. Verify that the cheque contains all standard security features, such as watermarks, holograms, and microprint, which are common on legitimate cheques.

2. Issue Cheques to Trusted Parties Only

Avoid issuing cheques to unknown individuals or entities without a clear and documented transaction. Ensure that written agreements, including the cheque number and purpose of payment, are in place to prevent misuse.

3. Maintain Cheque Security

Keep your cheque book in a secure location and monitor access to it. Store cheques safely to avoid the risk of theft or manipulation by unauthorized individuals.

4. Enhance Banking Security Features

Work with your bank to implement enhanced security features, such as dual signatories for cheque approvals, SMS alerts for cheque payments, and online banking notifications. These features allow you to monitor cheque transactions in real-time and detect suspicious activity.

5. Regularly Check Bank Statements

Make it a habit to review your monthly bank statements and transaction notifications. Early detection of unauthorized or fraudulent cheque payments allows you to act quickly and take legal steps to recover any lost funds.

6. Avoid Cheque Payments for Unknown Parties

Where possible, rely on secure electronic payments, such as bank transfers or credit cards, especially when dealing with unknown parties. Electronic payments provide an additional layer of security, reducing the likelihood of cheque fraud.

7. Use Your Own Pen

When signing a cheque, always use your own pen. This can prevent fraudsters from substituting a special “magic ink” pen that fades over time, allowing them to alter the cheque details.

What to Do If You Encounter Cheque Fraud

If you become a victim of cheque fraud, it is essential to act promptly. Here are the immediate steps you should take:

- Notify the Bank – Contact your bank immediately to report the fraud. Provide them with all relevant details, including the cheque number, the fraudulent amount, and the circumstances surrounding the fraud.

- File a Police Report – Cheque fraud is a criminal offense in the UAE, and you must file a report with the local police. The police will investigate the case and may refer it to the UAE courts for further legal action.

- Consult Legal Assistance – Seek legal advice from a qualified attorney to understand your rights and explore potential recourse, especially if you need to file a lawsuit against the fraudster.

- Document the Fraud – Keep detailed records of the fraudulent transaction, including copies of the cheque, communications with the bank, and any legal documents. This documentation will be crucial if the case goes to court.

Cheque fraud cases in the UAE have become increasingly common, with fraudsters finding creative and deceptive ways to exploit individuals and businesses. Understanding the different types of cheque fraud, such as fake cheques, cheque manipulation, and magic ink fraud, can help you stay vigilant and take proactive measures to protect yourself. By following the preventive tips mentioned above and acting swiftly in the event of fraud, you can significantly reduce your risk of falling victim to cheque fraud in the UAE. Always stay alert and prioritize security when dealing with cheques to ensure that your financial transactions remain safe and fraud-free.

With technological advancements and growing concerns over cheque fraud, financial institutions in the UAE are continually evolving to implement stronger security measures. While fraudsters may develop new tactics, banks and regulators are working to stay one step ahead, ensuring better protection for their customers.

1. Digital Cheque Clearing Systems

One significant development in fraud prevention is the use of digital cheque clearing systems. These systems enable banks to process cheques electronically, reducing the chances of cheque manipulation or theft. In the UAE, this system is already in place and has helped accelerate cheque processing times while minimizing fraud risks.

2. Blockchain Technology

The introduction of blockchain technology in banking is expected to revolutionize how cheque transactions are handled. Blockchain’s transparent and decentralized nature ensures that all transactions are permanently recorded, making it nearly impossible for fraudsters to manipulate or forge cheque details. Banks and financial institutions in the UAE are exploring blockchain as a way to enhance transaction security and reduce fraud.

3. Artificial Intelligence (AI) and Machine Learning

AI and machine learning technologies are also being used to detect unusual patterns or behaviors that may indicate cheque fraud. Banks can analyze large amounts of data in real-time, flagging suspicious transactions or manipulations before they occur. As AI systems become more advanced, they will play a crucial role in identifying and preventing fraud before any financial loss takes place.

4. Education and Awareness Campaigns

To prevent cheque fraud, public awareness is vital. UAE banks and financial institutions regularly launch educational campaigns to inform customers about the dangers of cheque fraud and provide tips on how to protect themselves. This education is especially important for businesses and individuals who frequently rely on cheques for financial transactions.

How UAE Regulations Support Fraud Victims

In the UAE, victims of cheque fraud have the support of stringent legal frameworks that offer remedies and justice. As mentioned earlier, Federal Law No. 18 of 1993 on commercial transactions addresses the criminal aspects of cheque fraud. Additionally, the UAE courts and police take a proactive approach to investigating and prosecuting cheque fraud cases, providing victims with legal avenues to seek compensation and justice.

1. Decriminalization of Bounced Cheques (In Certain Cases)

While the UAE has made efforts to decriminalize the act of bouncing cheques for reasons such as financial difficulties, cheque fraud itself remains a serious criminal offense. If a cheque is deliberately forged or manipulated, the legal consequences are severe, including imprisonment and heavy fines. This distinction ensures that genuine victims of fraud are not penalized while targeting intentional criminals.

2. Financial Fraud Protection by Banks

Banks in the UAE provide several mechanisms to help victims of cheque fraud. If a fraud is detected, most banks have dedicated teams to assist customers in recovering lost funds and pursuing legal action. Some banks even offer insurance to cover potential losses due to fraudulent cheque activity.

The Role of Technology in the Fight Against Cheque Fraud

As technology becomes an integral part of banking, financial institutions are better equipped to combat cheque fraud. UAE banks have made significant investments in technologies that automate fraud detection and prevention. This technology ensures that even if a cheque passes through initial verification stages, further scrutiny can identify fraud during clearing.

1. Biometric Verification

Biometric systems, such as fingerprint and facial recognition, are increasingly being used to authenticate cheque signatories. This ensures that only authorized individuals can issue cheques, minimizing the risk of fraudulent signatures. As biometric technology becomes more widespread, it will act as a powerful deterrent against cheque fraud.

2. Mobile Banking and Remote Cheque Deposit

Many UAE banks now offer remote cheque deposit options via mobile banking apps. Customers can deposit a cheque by taking a photo and submitting it electronically. This eliminates the need for physical cheques to be transported or mailed, reducing the risk of cheque theft or manipulation.

Best Practices for Businesses to Prevent Cheque Fraud

Businesses in the UAE, particularly those that issue and accept cheques regularly, are more vulnerable to cheque fraud. To mitigate this risk, companies can adopt specific best practices tailored to their operations:

1. Implement Strong Internal Controls

Businesses should establish internal processes that involve multiple layers of review and approval for cheque issuance. This may include requiring dual signatures on cheques above a certain value, verifying beneficiary details before issuing payments, and conducting regular audits of cheque transactions.

2. Secure Cheque Storage

Cheques should be stored securely, with limited access to authorized personnel only. This prevents the risk of cheque theft or manipulation by employees or external parties.

3. Reconcile Bank Statements Regularly

Business owners should ensure that bank statements are reviewed and reconciled on a regular basis. By identifying discrepancies early, businesses can take immediate action to address any potential cheque fraud.

4. Invest in Fraud Detection Software

Businesses can also invest in specialized fraud detection software that monitors cheque transactions and flags any unusual patterns or activity. This can be especially useful for companies that deal with a high volume of cheque transactions.

Conclusion: Staying Vigilant in the Fight Against Cheque Fraud

As cheque fraud cases in the UAE continue to evolve, staying vigilant is crucial. Whether you’re an individual issuing a personal cheque or a business owner handling large payments, understanding the different types of cheque fraud and implementing preventive measures can protect you from falling victim to this financial crime.

Technology will continue to play a pivotal role in detecting and preventing cheque fraud, but awareness and caution remain key. By being proactive, following the preventive tips provided, and working closely with your bank, you can minimize the risk of cheque fraud and ensure that your financial transactions remain secure.

If you find yourself in the unfortunate situation of becoming a victim of cheque fraud, remember to act swiftly by notifying your bank, filing a police report, and seeking legal assistance. The UAE’s legal framework is designed to protect victims of financial fraud, and with the right steps, you can recover your losses and bring the fraudsters to justice.

Stay informed, stay alert, and safeguard your finances from cheque fraud.

Frequently Asked Questions (FAQ) About Cheque Fraud in the UAE

Cheque fraud is a significant concern in many parts of the world, including the UAE. This FAQ will address common queries and provide insights into how to protect yourself from cheque fraud, what legal recourse is available, and what to do if you become a victim.

1. What is cheque fraud?

Cheque fraud refers to any fraudulent activity involving the use of cheques to deceive individuals or institutions into handing over money. Fraudsters either create fake cheques, manipulate genuine ones, or steal signed cheques to gain unauthorized access to funds. This type of fraud is common globally and can lead to serious financial and legal consequences for both the victims and perpetrators.

2. How common are cheque fraud cases in the UAE?

Cheque fraud cases are relatively common in the UAE, especially given the country’s reliance on cheques for many business and personal transactions. With businesses and individuals frequently issuing cheques, fraudsters have found ways to exploit the system, leading to a growing number of fraud cases.

However, with stringent regulations and technological advancements, UAE authorities are actively working to reduce cheque fraud. Public awareness has also played a significant role in preventing such fraudulent activities.

3. What are the different types of cheque fraud?

Cheque fraud can occur in several forms. Here are the most common types:

- Fake Cheques: Fraudsters create counterfeit cheques that appear authentic. These cheques are often based on copied details from genuine cheques, making them hard to identify at first glance.

- Cheque Manipulation: A legitimate cheque is manipulated to change important details such as the amount, date, or payee’s name. For instance, a cheque written for AED 1,000 may be altered to show AED 10,000.

- Magic Ink Technique: Fraudsters use special ink that disappears after a while. Once the ink fades, the cheque can be rewritten with new details, allowing fraudsters to manipulate the amount or payee.

- Cheque Theft: A signed cheque is stolen and deposited by someone other than the intended beneficiary. This often occurs when cheques are intercepted in transit or stolen from the cheque issuer’s possession.

4. What are the legal consequences of cheque fraud in the UAE?

In the UAE, cheque fraud is treated as a serious offense. The legal consequences for those found guilty of cheque fraud can include:

- Imprisonment: Fraudsters may face jail time depending on the severity of the fraud.

- Fines: Heavy fines can be imposed on individuals or organizations involved in cheque fraud.

- Criminal Record: A conviction for cheque fraud can lead to a permanent criminal record, impacting an individual’s future opportunities for employment or business.

Cheque fraud is governed by Federal Law No. 18 of 1993 concerning commercial transactions. The law addresses both the criminal and civil aspects of cheque fraud, ensuring that victims can take legal recourse and perpetrators are held accountable.

5. How can I avoid becoming a victim of cheque fraud?

Preventing cheque fraud requires caution and vigilance. Here are some steps you can take to protect yourself:

- Examine Cheques Carefully: Before accepting or issuing a cheque, examine it closely for any signs of tampering. Look for overwriting, suspicious markings, or erased details.

- Use Secure Payment Methods: Whenever possible, opt for secure payment methods like bank transfers instead of cheques, especially when dealing with unknown individuals or businesses.

- Verify Cheques: Always verify the authenticity of a cheque with your bank before accepting it as payment, particularly for large amounts.

- Secure Your Cheque Book: Keep your cheque book in a safe place and ensure it is only accessible to authorized personnel.

- Implement Dual Signatures: For businesses, consider implementing a dual-signature requirement for high-value cheques. This adds an extra layer of protection.

6. What should I do if I suspect I’ve been a victim of cheque fraud?

If you suspect that you have been a victim of cheque fraud, it is important to act quickly. Here are the steps you should take:

- Notify Your Bank: Immediately contact your bank and inform them about the suspected fraud. They may be able to stop the cheque from being processed or help you recover lost funds.

- File a Police Report: Cheque fraud is a criminal offense in the UAE. Filing a police report is necessary for legal action to be taken against the fraudster.

- Consult a Lawyer: Seek legal advice from a qualified lawyer who specializes in financial fraud. They can guide you through the legal process and help you recover any losses.

- Gather Evidence: Keep copies of all relevant documents, including the fraudulent cheque, any communication with the fraudster, and your bank records. These will be crucial if the case goes to court.

7. Can businesses be victims of cheque fraud?

Yes, businesses are frequently targeted by cheque fraud, especially those that rely on cheques for high-value transactions. Fraudsters may manipulate a company’s cheques or issue fake cheques to deceive businesses into providing goods or services without payment.

Businesses should take extra precautions by implementing strict internal controls, such as dual-signature policies, regularly reconciling bank statements, and using fraud detection software to monitor cheque transactions.

8. Are there any technologies that can help prevent cheque fraud in the UAE?

Yes, several technologies are being used by banks and businesses in the UAE to prevent cheque fraud:

- Digital Cheque Clearing Systems: These systems allow cheques to be cleared electronically, reducing the risk of physical cheque theft or manipulation.

- Biometric Verification: Some banks offer biometric verification for cheque signatories, ensuring that only authorized individuals can issue cheques.

- Mobile Banking Apps: UAE banks increasingly offer mobile apps that allow users to deposit cheques remotely by taking a photo, reducing the risk of theft or fraud during transit.

- AI-Powered Fraud Detection: Advanced AI systems can analyze transaction patterns and detect unusual or suspicious activity, flagging potential fraud before it occurs.

9. Are bounced cheques considered fraud in the UAE?

Bounced cheques are not automatically considered fraud, as they can happen due to insufficient funds, oversight, or misunderstanding. However, in the UAE, issuing a cheque that cannot be honored (i.e., a bounced cheque) can lead to legal consequences, including fines and possible jail time, depending on the circumstances.

The UAE has decriminalized certain cases of bounced cheques, especially for individuals facing financial difficulties. However, deliberately issuing a cheque that you know cannot be honored can still lead to serious penalties.

10. What steps has the UAE taken to reduce cheque fraud?

The UAE government and banking sector have implemented several measures to combat cheque fraud, including:

- Legal Reforms: The UAE has introduced legal reforms that decriminalize certain cases of bounced cheques while maintaining strict penalties for cheque fraud.

- Public Awareness Campaigns: Banks and government authorities frequently run awareness campaigns to educate the public about the risks of cheque fraud and how to avoid it.

- Technological Advancements: Banks in the UAE use state-of-the-art technology, such as AI, blockchain, and biometric verification, to detect and prevent cheque fraud.