The UAE’s Virtual Assets Regulatory Authority (VARA) is a newly-established organization that will regulate and oversee the development of the virtual assets industry in the country. The authority will work to ensure the legitimacy and transparency of transactions involving virtual assets, as well as develop standards and best practices for the industry. Let’s take a look at what VARA is and what it plans to do in the UAE.

What is the Virtual assets Regulatory Authority?

The Virtual assets Regulatory Authority (VARA) is a federal authority in the United Arab Emirates responsible for regulating virtual assets and related activities. VARA was established by Federal Decree No. 12 of 2018 and is headquartered in Abu Dhabi.

VARA’s mandate is to develop and implement regulations for virtual assets and related activities, as well as to promote the use of virtual assets in a manner that ensures safety, security, and consumer protection. VARA is also responsible for issuing licenses for businesses engaged in virtual asset-related activities, and for supervising and enforcing compliance with regulatory requirements.

The key regulations issued by UAE’s Virtual assets Regulatory Authority

- Regulation on Virtual Asset Service Providers: This regulation sets out requirements for businesses engaged in providing services related to virtual assets, such as exchanges, wallets, and custodians.

- Regulation on Initial Coin Offerings: This regulation sets out disclosure requirements and prohibited practices in relation to initial coin offerings.

- Regulation on Virtual Asset Trading Platforms: This regulation sets out requirements for businesses operating virtual asset trading platforms.

In addition to the above regulations, VARA has also issued guidance on a number of topics related to virtual assets, including taxation, anti-money laundering, and countering the financing of terrorism.

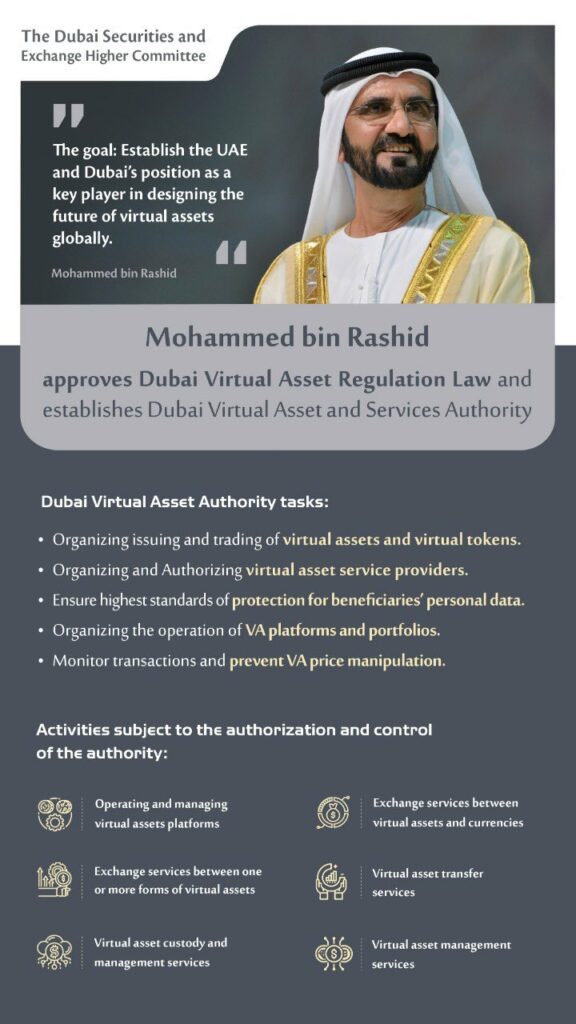

On 11 March 2022, Dubai Law No. 4 of 2022 Regulating Virtual Assets in the Emirate of Dubai (the “Law”) came into effect. The Law establishes the foundation of a regulatory regime for virtual assets in Dubai with the goals of protecting investors and promoting responsible business growth. To achieve those goals, the Law: (i) creates a virtual assets regulator; (ii) empowers the regulator to create appropriate laws and regulations; (iii) defines “Virtual Asset”; and (iv) identifies services that will require a license.

Effects of the Virtual assets Regulatory Authority

The first six months of this Law have seen Dubai’s dedicated virtual assets regulator, the Dubai Virtual Assets Regulatory Authority (“VARA”), take two important steps.

Firstly, it has issued administrative orders governing the marketing, advertising, and promotion of Virtual Assets. Secondly, it has issued provisional approval to operate in Dubai—referred to as a Virtual Asset Minimum Viable Product License (“MVP License”)—to several global crypto, blockchain, and digital asset market participants.

What does the Future behold for Dubai’s Virtual assets Regulatory Authority?

VARA has been established as an independent entity with financial and administrative autonomy to achieve the goals of the Law. VARA’s jurisdiction spans across the Emirate of Dubai, including in all its free zones other than in the DIFC. Once the Law’s implementing regulations are adopted, industry participants must establish a presence in Dubai, register with VARA, and obtain a license prior to engaging in any of the virtual assets activities identified in the Law.

VARA is mandated to protect investors and dealers in Dubai by monitoring transactions and preventing price manipulation of virtual assets. It has a broad range of powers to classify, define, regulate, expand, and prohibit these activities.

Responsibilities of Virtual Assets Regulatory Authority

- Issuing and enforcing the applicable rules in Dubai (excluding the DIFC) and developing a code of ethics;

- Establishing additional controls for conducting virtual assets-related activities, such as the provision of management, clearing, and settlement services for virtual assets;

- Assessing, classifying, and specifying the different types of virtual assets;

- Preparing the general policy and strategic plans related to the regulation of virtual assets services;

- Supervising, licensing, and regulating the sector across Dubai’s mainland and the free zone territories (again, excluding the DIFC); and

- Providing anti-money laundering support and raising public awareness on dealing in virtual assets and their associated risks.

The Virtual Assets Regulatory Authority undertakes its regulatory responsibilities in coordination with the Dubai Digital Authority, as well as with UAE federal regulators such as the Central Bank of UAE and the Securities and Commodities Authority. These regulators’ oversight somewhat overlaps, and therefore, market participants in Dubai need to carefully consider all relevant regulations and engage with all three regulators at an early stage of any enterprise.

What are Virtual Assets?

Virtual Assets in principle are “digital representation[s] of value that can be digitally traded, transferred or used as an exchange or payment tool or for investment purposes, including virtual tokens, and any digital representation of any other value as determined by VARA.

Not only is this a broad definition, but its final limb empowers VARA to determine what may constitute a virtual asset, giving the regulator an element of control over the asset class. This reinforces the importance of market participants proactively engaging with regulators and advisors at an early stage.

The definition contains elements that are common to the legislative approach in other jurisdictions. For example, under the Law, “Virtual Assets”: (i) are “created electronically/digitally”; (ii) “confer digital representation of value”; and (iii) are “digitally traded or transferred”.

Legislation in the United States, England, Singapore, and the European Union use similar elements when setting the parameters for what constitutes virtual or digital assets. Of course, this should not be taken to mean that “Virtual Assets” under the Law would by default constitute virtual or digital assets in these other jurisdictions. This is a fast-developing area of law, and these salient elements can change as the asset class evolves.

Licensing Requirements for Service Providers

The Law requires service providers to establish a presence in Dubai, register with Virtual assets Regulatory Authority, and obtain a license prior to conducting any of the following virtual assets activities in Dubai or any of its free zones:

- Operating and managing virtual assets platform services;

- Exchange services between virtual assets and currencies, whether national or foreign;

- Exchange services between one or more forms of virtual assets;

- Virtual assets transfer services;

- Virtual assets custody, management, or control services;

- Services related to the virtual assets’ portfolio; and

- Services related to the offering and trading of virtual tokens.

VARA (Virtual assets Regulatory Authority) has been empowered to expand, classify, and/or further define the above activities and to set prohibitions on such practices.

Although the Law does not apply in the DIFC, as a practical matter, industry participants who wish to operate in the DIFC can at present do so from their onshore Dubai presence, given that neither the DIFC nor its regulator, the DFSA, have established a presence requirement.

It remains to be seen what VARA’s presence requirement will mean for truly decentralized technologies, as the Law does not provide an exception for such technologies. However, with both the gift of giving and the power to revoke licenses, VARA is now the ultimate gatekeeper into Dubai’s digital asset economy—with this in mind, prudent operators wishing to target consumers in Dubai would be well-advised to comply with the Law.

Implementing Regulations and Administrative Orders

The Law grants the Director General of the Dubai World Trade Centre Authority, of which Virtual assets Regulatory Authority (VARA) is a part, the power to adopt implementing regulations proposed by VARA and for VARA to issue administrative orders.

The timeframe for the issuance of any implementing regulations is not prescribed in the Law, and VARA (Virtual assets Regulatory Authority) has not disclosed its intended timeframe for proposing regulations. But under the Law, the Director General is empowered to issue regulations by publishing them on VARA’s website, without the need to publish in the Official Legal Gazette.

We expect the initial package of implementing regulations will set out, among other things, the administrative procedures related to the procurement of licenses, as well as the information and documents required of applicants for VARA to grant its approval. Ultimately, VARA’s role in proposing these regulations gives it a high degree of influence over the future direction of Dubai’s virtual assets regulatory regime.

On 25 August 2022, the Virtual assets Regulatory Authority issued its first two administrative orders. These orders establish: (i) the rules on marketing, advertising, and promotions related to virtual assets (the “Marketing Regulations”); and (ii) the fines applicable for breaches of the Marketing Regulations (the “Penal Regulations”). They are designed to ensure consumers, and in particular less sophisticated retail consumers, are safeguarded from unscrupulous actors in the industry.

Marketing Regulations issued by VARA

The Marketing Regulations provide a inexhaustive list of activities that constitute advertising and promotion. They also set out prescriptive guidelines on the nature of any advertising materials and how the promotion of virtual assets must be made in Dubai. Specifically, all marketing relating to virtual assets and/or virtual assets activities must:

- Be fair, clear, not misleading and clearly identifiable as marketing or promotional in nature;

- Not mislead in relation to the real or perceived advantages of virtual assets;

- Include a prominent disclaimer with respect to the volatility and unpredictability of the value of virtual assets;

- Not advocate that investments are safe, low risk, or that returns are guaranteed;

- Not imply that investment decisions are trivial, simple, easy, or suitable for all (without due diligence);

- Not imply that past performance of investments is an effective guide for, or guarantee of, a future return;

- Not imply an urgency to buy virtual assets in anticipation of future gains, or create a fear of missing out on future gains, by not buying now;

- Not advocate the purchase of virtual assets using credit or other interest accruing facilities;

- Ensure that any targeted marketing is undertaken responsibly by licensed entities, to present only appropriate products or services to the audience, including but not limited to defined criteria on investor qualification, and event attendance; and

- Otherwise comply with all applicable laws, regulations, guidelines, or other rules applicable across the UAE.

It’s expected that these rules will apply to marketing and promotional materials or activities in a broad set of circumstances, ranging from coin/product launches to crypto-related events and conferences. Stakeholders across the digital asset industry should be aware of their application. Interestingly, the Marketing Regulations are intended to apply to any entity that seeks to target or cater for UAE residents and customers, even if the promoter is a foreign entity that is not licensed by VARA.

How VARA will interpret the extent to which foreign entities “cater for residents” and therefore fall within the scope of the regulations is not yet clear. Even if a foreign entity falls within scope and is found to breach the regulations, it remains to be seen whether or how VARA will enforce its rules on an extraterritorial basis.

Enforcement and Penalties of Virtual assets Regulatory Authority

Violations of the Law or of its future regulations can result in penalties and fines, including the suspension or revocation of a license to engage in virtual assets activities or the revocation of the violating party’s commercial license.

In enforcing the Law and its related regulations, VARA has the capacity and powers of a judicial officer and can collaborate with the relevant local and federal authorities to access and seize records, documents, devices, and properties as needed. All persons, including virtual assets service providers, must cooperate with VARA and meet its requests in accordance with the provisions of the Law and its implementing regulations.

Penalties for noncompliance with the Marketing Regulations are set out in the Penal Regulations.

Fines start from AED 20,000 and go up to AED 500,000 per offence for repeat offenders. VARA reserves the right to revoke any VARA-issued license, rescind any approvals, and/or suspend any commercial trade license in coordination with the relevant regulatory authorities.

What is the Purpose of Virtual assets Regulatory Authority?

The Virtual assets Regulatory Authority (VARA) was established by the UAE Government in 2019 with the purpose of regulating virtual assets and related activities. VARA is responsible for issuing licenses to companies operating in the UAE’s virtual asset industry, and supervising and enforcing compliance with regulatory requirements.

The authority’s goal is to promote the development of the virtual asset industry in the UAE and create an environment that is conducive to innovation and investment. VARA also aims to protect investors and https://wirestork.com/wp-content/uploads/2024/08/Case-Inquiry-by-Passport-Number-Your-Ultimate-Guide-to-Checking-Criminal-Status-in-UAE-Financial-Cases-scaled-1.jpgs of virtual assets, while ensuring the stability of the UAE’s financial system.

Who is on the Board of Virtual assets Regulatory Authority?

The board of the Virtual assets Regulatory Authority is made up of representatives from the UAE’s Securities and Commodities Authority, the Abu Dhabi Global Market, and the Dubai Financial Services Authority. The authority is also supported by the Central Bank of the UAE.

What are the Key Regulations of Virtual assets Regulatory Authority?

The Virtual assets Regulatory Authority (VARA) is a regulatory body that was established in 2019 by the United Arab Emirates (UAE) government. VARA is responsible for regulating the activities of virtual asset service providers (VASPs) in the UAE.

VARA key Regulations

The key regulations of UAE’s Virtual assets Regulatory Authority are as follows:

1. VASPs must be licensed by VARA in order to operate in the UAE.

2. VASPs must comply with anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) regulations.

3. VASPs must implement measures to protect customer information and data.

4. VASPs must have robust risk management systems in place.

5. VASPs must provide regular reports to VARA on their activities.

What is the Future of Regulation for UAE’s Virtual assets Regulatory Authority?

The future of regulation for the Virtual Assets Regulatory Authority (VARA) is to ensure that all virtual asset activities in the United Arab Emirates (UAE) are conducted in a fair, transparent and orderly manner. VARA will also continue to work closely with other regulatory authorities in the UAE to ensure that investors are protected and that market integrity is maintained.

The UAE’s Virtual Assets Regulatory Authority is responsible for regulating and supervising all activities related to virtual assets in the country. The authority works to protect investors and ensure that the market is fair and transparent. It also ensures that businesses comply with anti-money laundering and countering the financing of terrorism regulations. The Virtual Assets Regulatory Authority is an important part of the UAE’s commitment to protecting its citizens and growing its economy.

So, how has the Virtual Asset regulation Authority Been Functioning Since Inception?

The first six months of this Law have seen VARA issue MVP Licenses to a number of global crypto, blockchain, and digital asset exchange applicants. The initial interest from global institutions is a positive step for Dubai’s digital asset ecosystem and reinforces the value of regulating the industry. Applicants will be required to apply for full VARA licenses in due course.

Given the breadth of powers granted to VARA, we expect its future implementing regulations and administrative orders could cover a broad range of matters, including:

(i) detail around the classification of the different types of virtual assets and tokens;

(ii) the issuance of a code of professional ethics binding on virtual asset service providers;

(iii) a regime establishing embargos on specific virtual assets and/or virtual asset-related activities; and

(iv) the development of rules and regulations related to KYC, anti-money laundering, and financial crime.

However, the extent to which virtual asset industry players with MVP Licenses actually establish long-term, meaningful operations in Dubai as a result of this new framework will depend very much on the details of the regime.

Frequently Asked Questions about Virtual assets Regulatory Authority

What are the key regulations of Virtual assets Regulatory Authority in the UAE?

The key regulations of UAE’s virtual assets regulatory authority include:

Regulation on Virtual Asset Service Providers: This regulation sets out requirements for businesses engaged in providing services related to virtual assets, such as exchanges, wallets, and custodians.

Regulation on Initial Coin Offerings: This regulation sets out disclosure requirements and prohibited practices in relation to initial coin offerings.

Regulation on Virtual Asset Trading Platforms: This regulation sets out requirements for businesses operating virtual asset trading platforms.

In addition to the above regulations, VARA has also issued guidance on a number of topics related to virtual assets, including taxation, anti-money laundering, and countering the financing of terrorism.

It’s expected that the regulations and orders to be established by VARA to cover a broad range of matters, including:

(i) detail around the classification of different virtual assets and tokens;

(ii) the issuance of a code of professional ethics binding on virtual asset service providers;

(iii) a regime establishing embargos on specific virtual assets and/or virtual asset-related activities;

and (iv) the development of rules and regulations related to KYC, anti-money laundering, and financial crime.

In the medium-term, we hope to see regulations defining the extent and scope of cooperation as between the United Arab Emirates’ (“UAE”) federal pan-emirate, individual emirate, and financial free zone regulators. This should enable market participants to offer digital asset-related products and services across the UAE without seeking approvals from multiple authorities.

What is UAE’s Virtual Assets Regulatory Authority?

The UAE’s Virtual Assets Regulatory Authority (VARA) is a newly-established organization that will regulate and oversee the development of the virtual assets industry in the country. The authority will work to ensure the legitimacy and transparency of transactions involving virtual assets, as well as develop standards and best practices for the industry. Let’s take a look at what VARA is and what it plans to do in the UAE.

The Virtual assets Regulatory Authority (VARA) is a federal authority in the United Arab Emirates responsible for regulating virtual assets and related activities.

VARA was established by Federal Decree No. 12 of 2018 and is headquartered in Abu Dhabi.VARA’s mandate is to develop and implement regulations for virtual assets and related activities, as well as to promote the use of virtual assets in a manner that ensures safety, security, and consumer protection.

VARA is also responsible for issuing licenses for businesses engaged in virtual asset-related activities, and for supervising and enforcing compliance with regulatory requirements.